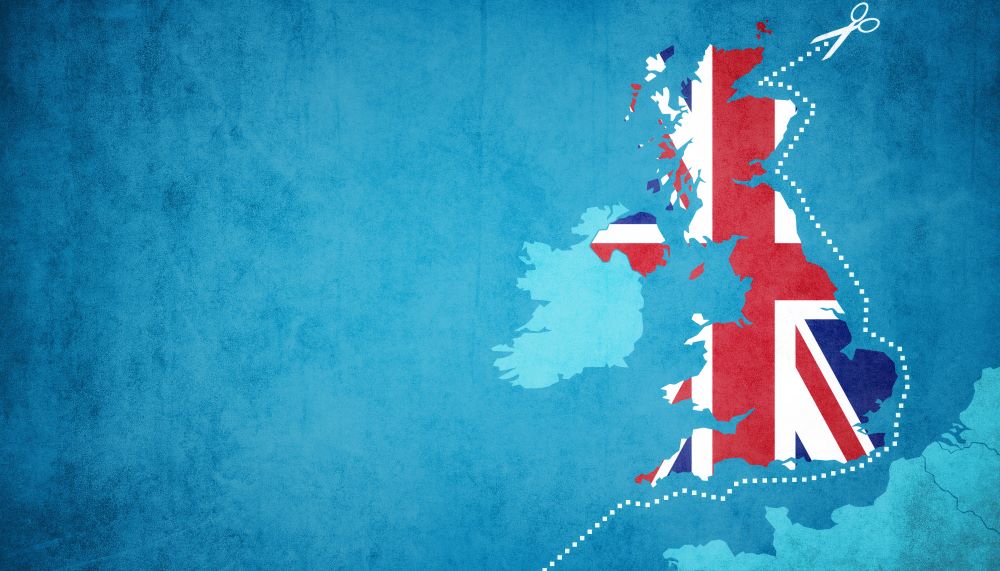

It’s been another busy week for traders adjusting to new rules following the completion of the UK’s split from the EU at the start of this year.

Here, the IOE&IT Daily Update rounds up three key developments you may have missed…

1. Collapsing meat exports

“Mountains of red tape” already leading to a collapse of meat exports to the EU, the British Meat Producers Association (BMPA) told the FT.

The industry trade body said total exports could drop by 20% and the sector faced ongoing costs of £120m a year due to new administrative requirements.

Although the government has dismissed problems at the border as “teething problems”, the BMPA said exporters now face permanent new barriers to trade, such as higher certification costs and the lack of an electronic tracing and certification network, leaving them dependent on printed paperwork.

2. Diverging paths

The UK and EU are already diverging in how they oversee financial services regulation in a blow to hopes of an equivalence deal, the FT also reports.

Rule changes around equity, fixed income and commodities trade underline the contrasting philosophies between the EU and UK on how markets should be regulated.

While the UK and EU are still involved in talks to agree an equivalence deal that would allow UK financial services company to continue operating in the EU as they do now, a lack of progress in these talks could lead to further divergence.

“If you’d asked us in the early autumn, we’d have said that equivalence is vitally important for every area and need to be sorted but things have developed – equivalence has a short shelf life,” said Baroness Rita Donaghy, chair of a House of Lords committee reviewing the future of UK-EU relations.

She urged the UK to strike a close relationship with the EU but admitted, “the atmosphere at the moment is rather cool, and that doesn’t help.”

3. Help for SMEs

HMRC will provide further customs and tax support to help companies adjust to new rules following Brexit, the government announced yesterday.

SMEs can already claim up to £2,000 in grants from the SME Brexit Support Fund for advice and training – which can go towards IOE&IT courses and consultancy.

HMRC is now also putting on free webinars and advice services around appointing customs intermediaries, applying for preferential duties and support moving goods through Northern Ireland.