| Article: by Arne Mielken BA(Hons) MA MIEx (Grad), IOE Young President |

|

|

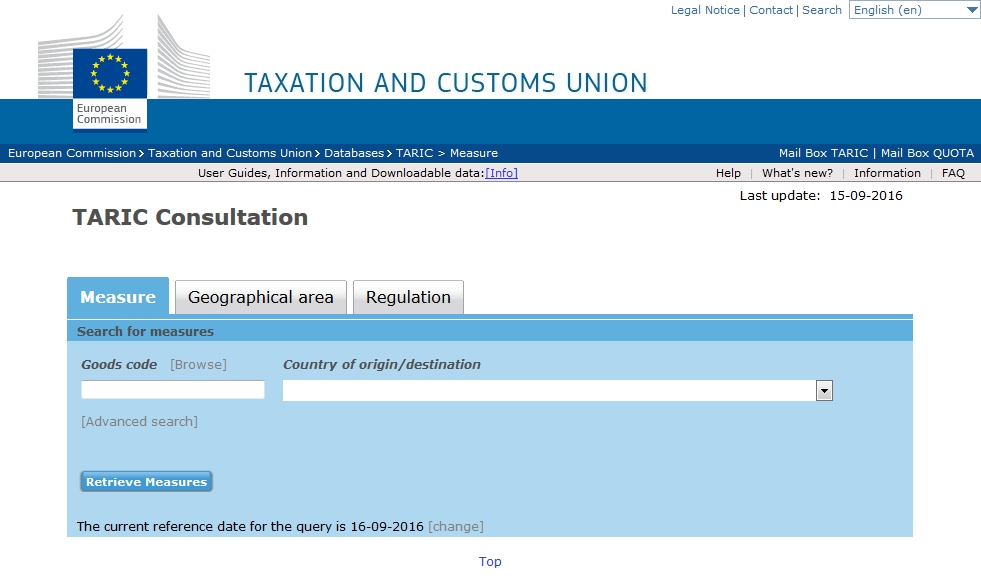

TARIC is an odd word. Google provides two equally unappealing choices. It is either the “Toronto and Region Islamic Congregation” or the “Tarif Intégré de la Communauté” (French: Integrated Tariff of the [European] Community). And this being Europe, and Europe being complicated, it is clearly the latter. Since the word “Community” is being replaced by “Union” (see UCC – Union Customs Code) soon this may change to TARIU – rest assured, there are no synonyms for this one (yet)! TARIC is complex – like anything in the EU, TARIC is mysterious – there are so many hidden secrets for you to discover and there are moments where you may wonder what is going on! TARIC will challenge you and make your brain work. And it is still only a database! Yet one of the most complex and important I have ever seen. TARIC – What is it all about? For a start it is multilingual, from English to Slovak to Maltese! This alone adds layers of complexity that are truly astonishing. Next, its aim is to not only display the EU Common Customs Tariff (which is a feast for international trade lawyers and specialists but not for the untrained eye) but also to integrate all import and export controls related to the EU customs tariff, covering not only customs duty rates but also all trade, commercial and agricultural legislation. By integrating these “measures”, the TARIC aims to provide a uniform application of all import and export controls by all EU Member States and give business information on the duty rates, controls and licence requirements when importing into the EU or exporting goods from the EU. What import and export controls does the EU undertake through TARIC and why? Controls at European level, for example, that aim to:

Noble goals, necessary objectives! But how does all this translate into TARIC? Well, setting aside the nobility, the nice words and kind explanations we are left with: Endless HS / CN codes, Latin words (like Erga omnes), abbreviations (like MFN, GSP etc.), links to endless EU legislation, footnotes (like CD464, TN701) and, above all, strange and ever-changing codes (like the famous X 002 or Y 901) thrown into the mix. Add a near endless list of countries and situations where duty reduction or suspension applies for various reasons and you can quickly grasp why some traders consider TARIC one of the last secrets on mother earth! Forgetting the measure code or getting it wrong = Non-compliance! But make no mistake, for traders, understanding what restrictions, prohibitions and controls apply in the EU is not optional – it is mandatory. In fact, importing and exporting cannot take place without proper codification of the measures in the customs filing systems of the EU Member States. The German e-customs filing system ATLAS (Automatisiertes Tarif- und Lokales Zollabwicklungssystem) for example will not allow you to submit an entry declaration unless the correct TARIC codes, including German specific qualifiers / codes are entered. As soon as a trader submits the customs information, the codes act as a “legal declaration” against which the authorities will verify the imported or exported goods. Getting the measure codes wrong or mixed up means clearance delays and possible fines and revocation of trading privileges. Conclusion Managing import and export controls in the EU is complex. Understanding the TARIC database is not optional as measure codes are a legal requirement. A company wishing to ease this complexity and reduce potential error rates can automate the process of checking licenses, restrictions and prohibitions by using global trade management solutions, for example by using Amber Road’s software suite which lists all TARIC control codes in addition to flagging all possible import and export controls for companies shipments. |

|

How the Institute can help The Institute of Export offers aDiploma in World Customs Compliance and Regulations which covers EU customs procedures in detail. The level 5 diploma, which is ideal for those working in trade or customs compliance roles, demystifies the complexities of international compliance and customs procedures – giving your businesses an advantage over your competitors. Created in consultation with some of the world’s leading companies, including Nissan, Adidas, BAE Systems and John Lewis, the course is designed to fit around a full-time career. Online lectures and workshops are used to teach course material, whilst graded assignments ensure that students have understood the subject matter. If you would like more information on the IOE’s membership, training and qualifications, please visit our website or contact us if you have any questions. |

Enter search criteria